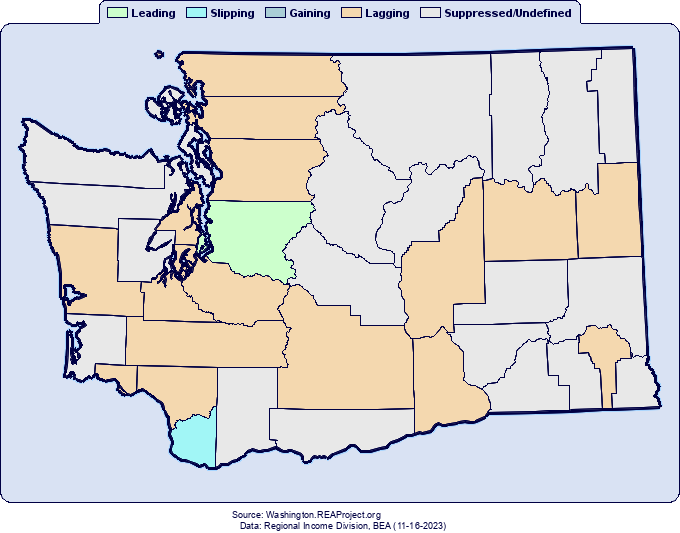

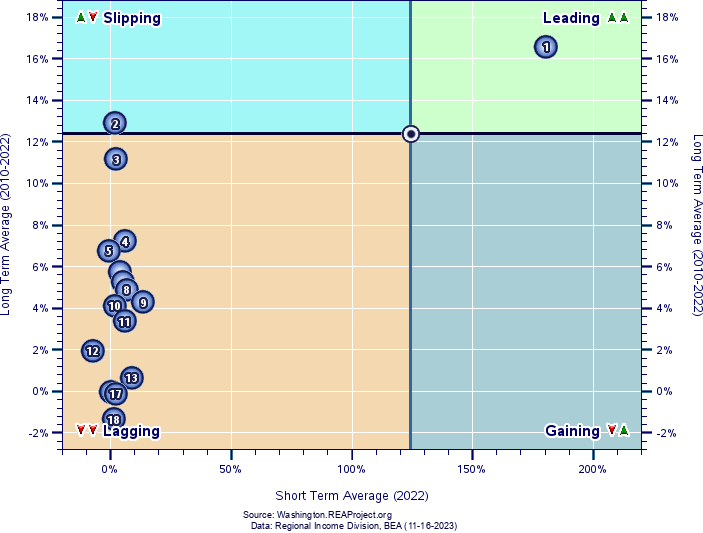

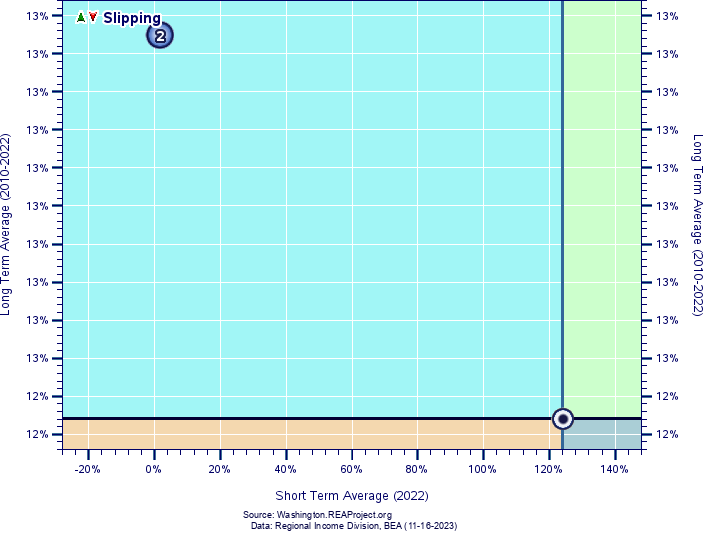

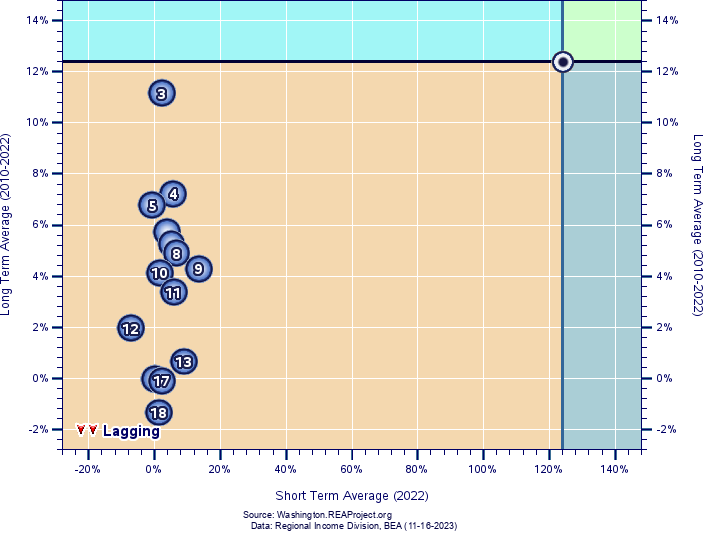

Leading, Slipping, Gaining, Lagging Analysis: Assessing Management of Companies and Enterprises Employment Growth Across Washington Counties  Briefing Report Outline: Page 1 of 8 Management of Companies and Enterprises Employment Growth County vs Statewide Average: 2010-2022 and 2022  Washington: 2010-2022 = 12.42% 2022 = 124.10% Borrowing from an approach that sometimes appears in the finance sections of the popular press, LSGL analysis is a handy and versatile way to compare, portray and classify the patterns of management of companies and enterprises employment growth across all of Washington's 39 counties. In finance, this technique is used for comparing and assessing the market performance of individual securities or across industry sectors. For example, the performance of the 30 stocks contained within Dow are compared with one another over the past week in contrast to their performance over the past month using the Dow's respective averages as the points of reference. Here in this Washington Regional Economic Analysis Project report, we adopt this approach to gauge and compare the management of companies and enterprises employment growth of Washington's 39 counties over the latest available year (2022) against the backdrop of their growth over the long term period (2010-2022). In so doing we classify their growth and performance into 4 broad categories: Leading, Slipping, Gaining and Lagging. Page 2 of 8 Management of Companies and Enterprises Employment Growth County vs Statewide Average: 2010-2022 and 2022  Washington: 2010-2022 = 12.42% 2022 = 124.10% This figure displays the 39 counties of Washington as dots on a scattergram, with the vertical axis representing the average annual management of companies and enterprises employment growth rate over the long-term period (2010-2022), and the horizontal axis representing the management of companies and enterprises employment growth rate for the near-term (2022). This figure sets apart those counties whose long-term management of companies and enterprises employment growth exceeded the statewide average of 12.42%, by portraying them in the top two quadrants demarcated at 12.42% on the vertical axis. County whose long-term average annual management of companies and enterprises employment growth rate trailed the statewide average (12.42%) are distributed in the bottom two quadrants. In all, 2 counties surpassed the statewide average over 2010-2022, while 16 counties fell below. Similarly, the two quadrants on the right of this figure present the positions of the 1 counties whose most recent (2022) management of companies and enterprises employment growth rate exceeded the statewide average (124.10%). The two quadrants on the left feature those 17 counties whose management of companies and enterprises employment growth over 2022 trailed the statewide average. Accordingly, each quadrant portrays the performance of all 39 counties corresponding with their long-term (2010-2022) and near-term (2022) performance relative to their respective statewide averages of 12.42% over 2010-2022 and 124.10% over 2022: Leading counties () (top-right quadrant)...are counties whose average annual management of companies and enterprises employment growth rate surpassed the statewide average both long-term (12.42%) and near-term (124.10%). Slipping counties () (top-left quadrant)...are counties whose long-term average annual management of companies and enterprises employment growth rate exceeded the statewide average (12.42%), but whose near-term growth has "slipped" by falling below the Washington average (124.10%). Gaining counties () (bottom-right quadrant)...are counties whose long-term average annual management of companies and enterprises employment growth rate fell below the statewide average (12.42%), but whose near-term growth has "gained" by registering above the average (124.10%) statewide. Lagging counties () (bottom-left quadrant)...are counties whose average annual management of companies and enterprises employment growth rate fell under the statewide average both long-term (12.42%) and near-term (124.10%).

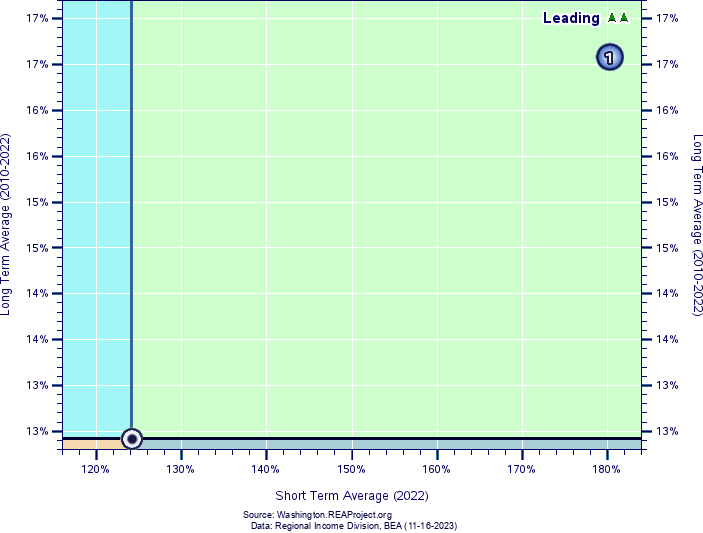

Page 3 of 8 Leading Counties 2022 vs. 2010-2022 Averages  Washington: 2010-2022 = 12.42% 2022 = 124.10% Turning attention to the top-right quadrant from the discussion above, this figure features the distribution of the Washington county classified as Leading. These counties surpassed Washington's average annual management of companies and enterprises employment growth both long-term (2010-2022 = 12.42%) as well as near-term (2022 = 124.10%). Each is identified by its corresponding ranking based on it's average annual management of companies and enterprises employment growth rate over 2010-2022. Of Washington's 39 counties, just 1 (3%) are classified within the Leading () category. Those counties ranked by their long-term average include:

Page 4 of 8 Slipping Counties 2022 vs. 2010-2022 Averages  Washington: 2010-2022 = 12.42% 2022 = 124.10% This figure depicts the distribution of the 1 Washington county classified as Slipping (top-left quadrant), in that their long-term average annual management of companies and enterprises employment growth rate outpaced the average statewide (2010-2022 = 12.42%), while they trailed the statewide average near-term (2022 = 124.10%). Again, each county is identified by it's corresponding ranking based on its average annual management of companies and enterprises employment growth rate over 2010-2022. Only 1 (3%) of Washington's 39 counties are classified as Slipping (). Those counties ranked by their long-term average include:

Page 5 of 8 Lagging Counties 2022 vs. 2010-2022 Averages  Washington: 2010-2022 = 12.42% 2022 = 124.10% This figure depicts the distributions of the 16 Washington counties classified as Lagging (bottom-left quadrant). These counties trailed the statewide average annual management of companies and enterprises employment growth both long-term (2010-2022 = 12.42%) as well as near-term (2022 = 124.10%). Again, each county is identified by its corresponding ranking based on it's average annual management of companies and enterprises employment growth rate over 2010-2022. 41% of Washington's counties, 16 of 39, are characterized here as Lagging (). Those counties ranked by their long-term average include: Page 6 of 8

Page 7 of 8 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||